At Vintage Acquisitions, we believe informed decision-making is the only way when it comes to alternative investments. Understanding the past performance of whisky casks provides critical context for their potential future value — particularly when assessed alongside traditional asset classes.

Historical Analysis

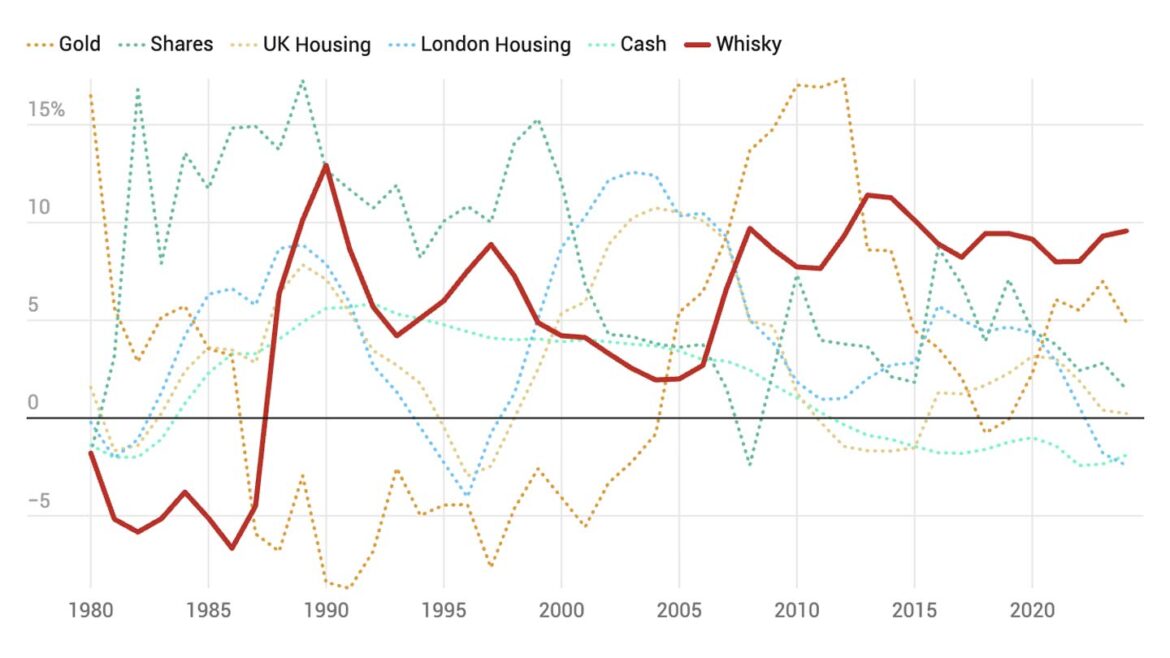

This is an in-depth study focusing on the performance of new-make spirit (0 years old) held for 8 years before being sold. Each result on the chart represents the exit year of the investment, with the acquisition made eight years earlier. For instance, whisky sold in 2020, originally acquired in 2012, delivered an average compound return of 9.15%, outperforming Gold (2.29%), UK Equities (4.46%), UK Housing (3.16%), London Housing (4.36%) and Cash (-1%) in the same timeframe.

All returns are shown net of inflation (adjusted using CPI) and expressed as Compound Annual Growth Rates (CAGR) — the gold standard for comparing long-term investment performance.

Note: All percentage figures have been rounded to the nearest whole or decimal figure for clarity.

Benchmarked Comparisons

To evaluate whisky’s strength as an investment, we compared its 8-year growth cycles with a range of other asset classes:

- London Residential Property

- UK Nationwide Housing

- Cash Savings Accounts

- UK Stock Market Equities

- Gold

- Scotch Whisky (0 to 8 years old)

This comparison reveals how whisky performs, not only as a standalone asset, but also in relation to other instruments commonly found in balanced portfolios.

Why the 0–8 Year Investment Window?

This specific holding period captures a particularly dynamic growth phase in whisky’s life cycle. New-make spirit is acquired at entry-level pricing, and as it matures (especially between years 5 and 8) it becomes increasingly valuable for trade buyers, bottlers and blenders alike.

This 8-year cycle represents a sweet spot where value tends to rise steadily (assuming proper storage and cask management), making it ideal for medium-term investors. Although whisky often continues to appreciate beyond 8 years, the market becomes more niche and liquidity can decrease.

Significantly, no 8-year holding period since 1987 has resulted in a loss for Scotch whisky cask investors, a claim not matched by any of the other benchmarked assets.

Note: Percentages have been rounded to the nearest decimal place.

Data Source: BullionVault.com, UK Annual asset class performance comparison, 1974-2023. Available at: BullionVault.

Key Takeaways for Investors

- Consistent, inflation-beating returns: Whisky has delivered attractive real-term growth during times of both economic stability and volatility.

- Low market correlation: As an alternative asset, its performance is largely unaffected by movements in equity or housing markets, helping buffer broader portfolio risk.

- Diversification made tangible: Unlike paper-based alternatives, whisky is a physical asset giving investors a sense of connection, provenance and security.

Our Philosophy at Vintage Acquisitions

We don’t see whisky as a speculative trend. We treat it as a strategic, well-managed asset class. Through Vintage Acquisitions, investors gain access to a carefully curated selection of whisky casks from across Scotland spanning multiple distilleries, regions and age brackets.

This built-in diversification helps reduce risk while offering tailored exit strategies, whether you’re looking for medium-term returns, legacy planning or gifting options.

Ready to explore whisky as part of your portfolio strategy?

Contact us today and discover how cask whisky investment with Vintage Acquisitions could support your long-term financial goals.