Own a Scotch Whisky Cask with Confidence

HMRC Approved Storage · Fully Insured · Transparent Ownership Process

Discover how owning a Scotch whisky cask can offer collectors and investors alike a tangible, fully insured heritage asset stored securely in Scotland’s bonded warehouses.

✔ Tangible, heritage-backed asset

✔ HMRC approved Campbeltown Bond warehouse

✔ Fully insured against loss or damage

✔ Transparent documentation via Delivery Orders

✔ Visit, taste & touch your cask in person

Begin your journey into whisky ownership today. Download Your Free Investmem Guide

* You must be 18 or over to order with Vintage Acquisitions ** See 5-Step Approach Section | 1. Whisky cask investments are unregulated in the UK | 2. The value of investments is variable and can go down as well as up | 3. Fees apply and these are outlined in our terms and conditions | 4. The volume of spirit will decrease over time, commonly known as ‘the Angels’ share’, see website for more details.

Established 2011

A Tangible Whisky Alternative to Traditional Investments

While financial markets fluctuate, Scotch whisky quietly matures — gaining heritage and complexity over time. Owning a cask allows you to participate in one of Scotland’s oldest and most respected industries through physical, fully insured ownership.

Unlike typical financial products, you own the asset outright. Each cask is individually numbered, insured and stored under HMRC supervision in Scotland’s Campbeltown bonded warehouse.

Why Use Us?

Why Collectors and Investors Choose Vintage Acquisitions:

✔ Tax Efficient Investment

✔ Tangible Asset

✔ Strong Historical Returns

✔ Limited Supply, Growing Demand

✔ Visit Your Cask in Person

✔ Hedge Against Inflation

✔ Your Own Whisky Pension

How Whisky Cask Ownership Works

Choose Your Cask

Our team sources a curated range of single malt single cask Scotch whisky from reputable distilleries.

Ownership Documentation

Receive a Delivery Order in your name confirming your cask’s details and bonded location.

Secure Storage & Insurance

Your cask remains under bond, fully insured and supervised by HMRC in temperature-controlled conditions.

Exit Support When Ready

When you decide, we can assist with bottling, sale, or transfer — offering complete transparency throughout.

Purchasing casks of single malt Scotch whisky is rapidly becoming a popular choice for both new and seasoned investors looking to secure long-term growth.

Learn how to invest in some of the worlds leading Scotch Whisky brands. Download our free whisky cask investment guide today!

Our client Rod shares his experience.

Welcome on board

Invest with insight

Begin building a portfolio, choosing from our extensive inventory or speaking to an senior account manager. You’ll receive full certification of ownership and your casks will be transferred to Campbeltown Bond where you will have full autonomy over your cask(s) via an independent, cutting-edge, cask maturation software ‘Vapour’.

Why Scotch Whisky Casks Appeal to Investors and Collectors

Whisky isn’t just enjoyed — it’s collected, celebrated and passed down.

A Tangible, Appreciating Asset

Invest in something real — authentic, maturing Scotch whisky casks within a thriving global market valued at $26.9 billion (Global Market Insights, Nov 2024). Unlike paper-based assets, whisky matures in both age and value, offering investors a unique blend of enjoyment and opportunity.

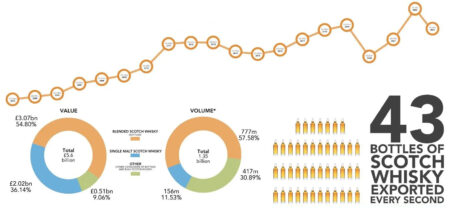

Consistent UK Price Growth

According to Statista (Sept 2025), whisky prices across the UK have shown steady year-on-year growth since 2021 — a trend forecast to continue. This resilience highlights whisky’s enduring strength as a long-term asset within the alternative investment landscape.

Proven Global Expansion

The global Scotch whisky market is projected to reach $138 billion by 2034, with a compound annual growth rate of 6.7% (Global Market Insights, Nov 2024). As global demand expands, limited supply continues to drive value upward for quality casks.

Rare Whisky’s Exceptional Performance

The Scotch Whisky Association (SWA) reports that Scotch whisky is a major Scottish export, with 2024 global exports valued at $5.4 billion.

Blue-chip Distilleries

We source from the best Scottish distilleries

The Vintage Whisky Group

About Vintage Acquisitions

Established in 2011, Vintage Acquisitions is part of the Vintage Whisky Group — one of the UK’s most respected whisky cask specialists.

We manage thousands of casks across Scotland, offering full transparency, secure storage, and a highly personal service for every client.

Through our unrivalled network, we also provide exclusive access to some of Scotland’s most renowned private distilleries — opportunities you simply won’t find anywhere else.

Client Experiences

Memorable Whisky Cask Ownership Events

Partners

Financial Times

Best Whisky Cask Investment - The Tax benefits

We take the time to understand your reasons and requirements for investing in Scotch cask whisky and only then do we make calculated recommendations from a position of knowledge.

CGT: Capital Gains Tax

Cask whisky is CGT free meaning to you that you are 24% better off day one on gains you make in the future.

One of the key advantages of investing in whisky casks as a “wasting asset” is that the capital gains tax liability is exempt. When you sell a whisky cask and realise a capital gain (the difference between the purchase price and the selling price), that gain is not be subject to capital gains tax.

IHT: Inheritance Tax

There is no IHT between husband and wife, it directly affects your children and grandchildren. On second death of husband and wife all assets are totalled up by HMRC and taxed at 40% over and above the ‘nil rate band (NRB)’ which is currently £325,000.

Create Your Own ‘Whisky Pension’

A “whisky pension” isn’t a regulated financial product. It’s a mindset shift — a tangible alternative to traditional paper-based savings. In times of fiscal tightening, the savviest investors look for assets that grow independently of government policy — real, finite, appreciating assets that are not subject to capital gains or income tax until realised.

Historical Performance – Source: SWA (Scotch Whisky Association)

Export Value Over 20 Years

Whisky Cask Investment Guide

Your Private Cask Awaits

Purchasing casks of single malt Scotch whisky is rapidly becoming a popular choice for both new and seasoned investors looking to secure long-term growth.

Learn how to invest in whisky with some of the worlds leading Scotch Whisky brands. Download our free cask ownership investment guide today!

* You must be 18 or over to order with Vintage Acquisitions | 1. Whisky cask investments are unregulated in the UK | 2. The value of investments is variable and can go down as well as up | 3. Fees apply and these are outlined in our terms and conditions | 4. The volume of spirit will decrease over time, commonly known as ‘the Angels’ share’, see website for more details.

You must be 18 or over to order with Vintage Acquisitions

*Vintage Acquisitions are not tax experts or financial advisers. If you need further clarification or advice on cask whisky purchasing please contact your financial adviser and tax specialist.

– Whisky cask investments are unregulated in the UK

– Fees apply and these are outlined in our terms and conditions

1. Vintage Acquisitions are not tax experts. If you need further clarification or advice on cask whisky purchase please contact your tax specialist or accountant.

2. We are not financial advisers, and the information in our brochure and on our website is purely to inform you about the nature of the Scottish whisky industry so that you can make an informed decision should you choose to buy a cask. We recommend you to speak to your financial adviser in the first instance.

3. The value of cask whisky can go up as well as down. If you wish to speak to someone regarding the cask buying process or any points raised in this guide or our website, please don’t hesitate to contact us.

4. If you wish to sample or bottle your cask. Please be aware duty and VAT will be due before the whisky has been bottled and the finished goods are removed from the HMRC licence warehouse. This remains the responsibility of the cask owner.

5. It is advisable to perform regular health checks on your cask every 3 years. Cask services are chargeable to the client, these include, regauging, samples and photographs.

6. Our WOWGR certificate (Departmental Trader Registration Number: 127 4643 13/0001) issued by HMRC, authorises us to store cask whisky in any appropriately approved Scottish excise warehouse. Therefore, we store casks of whisky across a number of distilleries and HMRC approved facilities in Scotland.